10 ways to reduce the rising costs in mortgage processes

Mortgage rates are far from returning to the norm. While the economic changes signaled an improvement in the rates for 2024, the market has yet to respond kindly, as the Federal Reserve has yet to decrease interest rates. In fact, the mortgage rate spiked back to above 7% in the second week of April after four months of gradual downtrend.

However, while mortgage rates remain high, Fannie Mae expects a gradual increase in mortgage applications, largely due to life events like people getting married or having children and not waiting for a drop in the mortgage rates to take their step toward homeownership.

That said, given the current financial environment, borrowers — especially first-time home buyers — are looking for affordable loans, which means mortgage lenders must work on reducing their origination costs to remain profitable.

Here’s an overview of how lenders can do that and how Truework can help.

Rising loan production costs

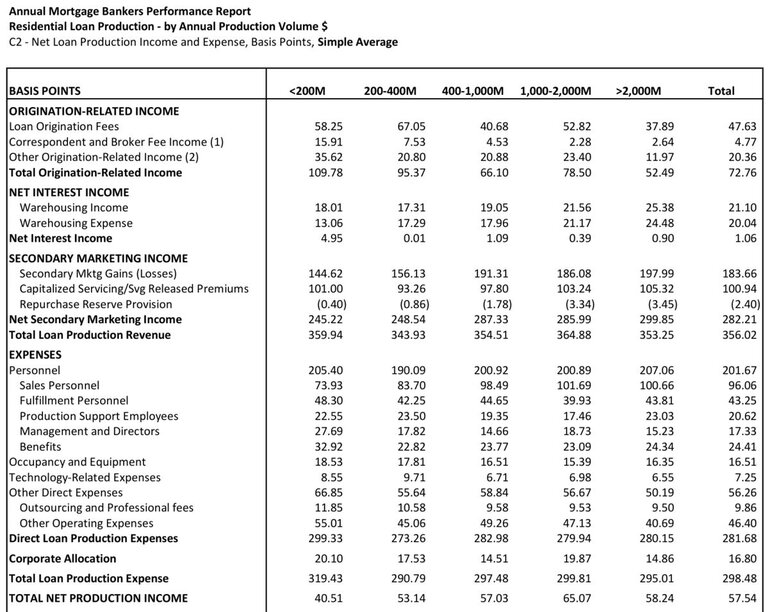

The cost to originate a mortgage loan makes up most of a mortgage lender’s processing fees. These include labor and equipment costs, commissions, and other production expenses. As of Q4 2023, the average cost to originate a mortgage loan is $12,485, up from $11,441 in Q3 2023.

While lenders have tried to control these costs by reducing their staff, they haven’t found much success. In a 2023 survey, 85% of the surveyed mortgage executives believed that their company was either not profitable or was at most breaking even due to the rising production costs.

Instead of opting for these methods, mortgage lenders must navigate their lending pipeline from start to finish to identify inefficient processes that increase costs.

How to reduce loan origination costs

Reducing the cost of processing loans is essential for mortgage lenders looking to enhance their operational efficiency and remain competitive.

While cutting these costs (or losses) requires systematic effort, lenders can start by analyzing the process, identifying inefficiencies, and adopting advanced tools for streamlining operations.

1. Assess the loan origination process

Mortgage lenders must examine how they manage loan origination, from the customer application to post-closing. They should note down the steps, observe how long the processes take, and look for bottlenecks.

To start the assessment, lenders can interview the best-performing employees to gain valuable insights into best practices and potential pain points. That’ll help lenders identify potential optimization opportunities (e.g., workflow bottlenecks where automation can improve productivity).

Beyond that, mortgage companies can also benefit from comparing their production expenses with companies of similar sizes using performance reports from the Mortgage Bankers Association (MBA).

Or, they can benchmark their lending performance in real time with analytics solutions, such as LendersBenchmark Analyzer.

2. Remove duplicate processes

Without a unified platform centralizing the relevant data, employees often end up repeating tasks.

For instance, they might ask borrowers to resubmit a document, make redundant calls to employers, or submit duplicate verification requests. These result in extra time and expenses, increasing the total loan production costs.

To address these issues, mortgage lenders can set up policies to prevent them from becoming the norm. Additionally, they can use specific tools to make the processes more streamlined.

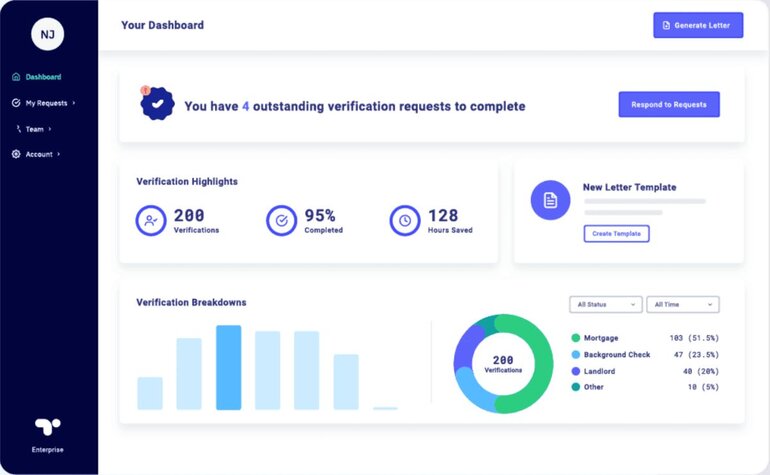

With Truework, mortgage lenders can have a centralized platform for income verification. Plus, its data accuracy guarantee removes duplicate verification costs.

3. Digitalize the application process

While many mortgage lenders have moved away from paper forms, they’re still surrounded by manual electronic processes for home loans. For instance, companies ask for digital copies of tax returns, but employees still have to review the details and enter them into their system.

To streamline such tasks and get more consistent data (free from errors due to re-entry), lending companies can benefit from building digital applications that collect borrowers’ information, gather relevant documents, and parse the data automatically.

Truework enables lending companies to add a customizable widget to their loan applications, giving them a head start in their digitalization journey without incurring a high upfront digital expense.

4. Incorporate new technology into mortgage processes

While labor costs are the major expense in mortgage processes, cutting staff alone doesn’t solve the problem. Instead, mortgage lenders just end up reducing their capacity for processing loans with less staff to work with.

As an alternative, Brian Quigley, the founder of Beacon Lending, recommends mortgage companies to make technology a part of their processes:

“By implementing automated workflows, digitizing documentation processes, and utilizing advanced data analytics, we've improved our operations significantly. This has not only increased efficiency but also minimized manual errors, resulting in increased cost savings.”

Data backs it up, too. Fannie Mae found that 37% of lenders found improvement in back-end technology to be a solution to their increasing costs.

In addition to adding new technology solutions, lenders should set up integrations to help their technology stack communicate with each other. This way, lending staff will spend less time moving data from one platform to another and more time helping borrowers move through the process.

With Truework API, lending companies can fully integrate and customize workflows, maximize verification coverage, and enhance operational efficiency.

5. Use AI-based tools to detect fraudulent applications

Humans can detect less than 10% of document fraud. So, even if mortgage companies allocate their lending staff’s time to scanning financial documents manually, they might still fail to filter out fraudulent candidates, thus trading operational efficiency for poor outcomes.

A better way to counter application fraud is to opt for AI-based tools that look for fraudulent patterns and flag suspicious applications. Truework Documents uses machine learning algorithms to convert data from submitted documents into standardized income reports while checking for fraud.

6. Adapt your tech stack to modern origination standards

Fannie Mac allows mortgage lenders to speed up their processes using its Day 1 Certainty (D1C) service in Desktop Underwriter (DU), which has helped many lenders decrease their loan cycle duration by up to 12 days.

That said, to use D1C, mortgage lenders must request verifications or credit scores from an authorized report supplier or distributor. With Truework, mortgage companies can expect to get D1C for up to 40% of their applicants with its access to 100 million income and employment records.

7. Reduce the underwriting cycle times

While the mortgage process involves a lot of cogs, mortgage lenders can automate one process at a time to reduce the overall closing time. For instance, a Freddie Mac study showed that lenders that relied on technology shortened their loan cycle times by 5-15 days.

To start, instead of relying on multiple verification vendors, manual outreach, and document review, lenders can look to platforms that unify and automate all of this tedious work to reduce loan cycle times.

Take it from Quigley, who shares, “By automating Beacon’s routine tasks with the help of AI-driven algorithms, we've been able to accelerate the underwriting cycle without compromising on accuracy or quality.”

Truework Income lets lenders verify borrowers' proof of income through instant employment records, user-permissioned payroll data, and Smart Outreach. The platform automatically chooses the best method based on the applicant’s information, giving lenders faster turnaround times and access to one of the industry’s highest completion rates (over 75%).

8. Develop standard operating procedures

If each individual on the lending team is doing their own thing, mortgage companies will have a hard time scaling up their efforts. With standard operating procedures (SOPs) in place, each employee will have a streamlined and consistent list of tasks on their plate, making them more efficient.

Plus, a standardized process leaves less room for errors, facilitates staff training, and helps lenders comply with relevant laws without leaving all the documentation for the end.

9. Monitor mortgage processes in real time

To keep hidden costs under check, mortgage lenders need a real-time dashboard to monitor their loan production costs. For example, the head of operations can use a dashboard that shows real-time status updates to see where employees spend most of their time.

If employees spend too much time on menial activities and have little time left for needle-moving tasks, the system needs a process adjustment. Additionally, managers can track how employees use new tools in their tech stack to see if they are benefiting from digital upgrades or if they require training.

10. Focus on customer-friendly policies

Instead of asking customers to go the extra mile and wait for weeks, build a process that goes the extra mile for customers.

For instance, mortgage lenders can make the borrowers’ lives easier by introducing verification methods that require less input from them — making it more attractive for borrowers.

This helps reduce the operational overhead expenses per loan in a much better way than reducing the workforce since the company ends up increasing (rather than decreasing) its processing capacity.

Truework enables mortgage managers to verify the proof of income of more than 48 million employees instantly, reducing the need for lengthy to-and-from document requests.

Leverage Truework to keep origination costs under control

With borrowers scouring the market to find the best mortgage loans with low closing costs while they search for an affordable new home, it’s on the mortgage companies to reduce their processing and underwriting costs to increase profitability

While it’s a tough battle for mortgage lending companies that have been under pressure ever since the Federal Reserve hiked its interest rates, they also have an opportunity to make their operations leaner by adopting tech solutions that reduce their total costs to originate.

Ready to learn more?

Truework enables lending companies to reduce redundant tasks, expedite verification processes, and hand over loans to the secondary market even faster.