How to stop wasting time on income verification discrepancies

The wasted time on getting income right

Do these scenarios sound familiar for your teams who manage verifications?

- They receive a completed application to begin the verification process, but they notice that the applicant’s job title and stated annual income seem off—perhaps too high or too low based on what they’ve seen on previous applications for similar employment.

- They receive an application and everything looks fine, so they move on to collect documents. They receive pay stubs and notice that the numbers on the application don’t match what’s on the pay stubs.

- They receive an application where the applicant has variable pay: hourly with overtime and an annual bonus. It’s going to require extra calculations to ensure everything is correct.

In these situations, your teams spend additional time and effort to ensure that income is accurate for underwriting. In some cases, their intervention is required as early as when the application is submitted. Additionally, it requires that your verifiers are constantly aware and on the lookout for errors. The time spent is already snowballing and putting timelines at risk, and that’s not taking into account the subsequent actions your team has to take to correct errors, such as:

- Comparing income numbers across all submitted documentation

- Getting back in touch with the applicant to ask for more information

- Contacting the employer(s)

- Manually researching employment and income information for certain jobs

At the end of the day, your applicants are the ones left with a lengthy loan process and a bad experience from your organization.

Income verification tools to help your teams save time

Mortgage providers and lenders today actively seek ways to minimize the manual tasks their teams have to do across the entire loan process—and ensuring accurate income is one of them. Some use tools to help identify fraud on collected documents, while some use tools to get in front of income errors from the start.

Why invest in these tools? Mortgage organizations recognize the need to optimize their teams’ time and efforts so that they don’t have to be involved in every menial task in the loan process. It’s all about pulling them in at the right time, when absolutely necessary.

Estimated Income to give your teams peace of mind

Estimated Income is Truework’s proprietary income estimation intelligence tool that helps identify and flag errors in reported income. It reduces the need for your teams to manually check income numbers by being a consistent, “always on” process that runs in the background. Additionally, it removes the need for your team members to have encyclopedic knowledge of expected income across all jobs. Instead, it allows your teams to focus on making final decisions with the model’s estimates as an input.

How does it work? Our estimation model takes into account a large set of reference and aggregated verification data to understand income across various inputs (e.g. job title, employer). From there, it organizes, cleans, and labels the data to be matched against what is found during a verification process, removing bias and errors. The model is constantly learning and being monitored by our internal engineering teams to ensure that income data is up-to-date and more use cases are being accounted for.

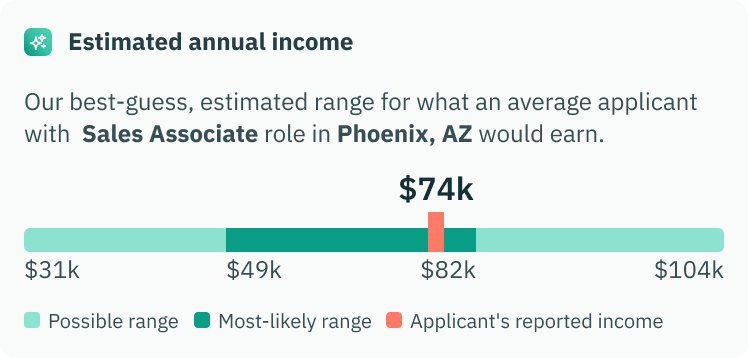

What does it look like? Estimated Income takes the reported annualized salary of the applicant along with other inputs and tells us if that number fits within the identified income range. In other words: Based on what the person told us about their income and employment, does it fit within the range of what we expect that person to make? Is it in the most likely range, a possible range, or way out of range?

If the income range makes sense, then the verification moves forward. If it doesn’t, then our internal teams work to reconcile the information. Examples of situations that have come through Estimated Income (a.k.a. things your teams no longer have to look out for) include:

- A mechanic’s hourly rate is entered as the annual salary, resulting in gross annual earnings of $50. Estimated Income flags this as far below minimum expected income.

- A medical assistant’s annual gross earnings is entered as $15,000, which falls below the range identified by Estimated Income and is flagged in case of input error.

- A warehouse worker reports a $17 hourly rate and a $3,000 annual bonus, which falls within the range identified by Estimated Income and is not flagged.

In the above scenarios, your teams spend significantly less time scanning for errors. The end result? Countless hours saved, happier teams, and happier clients.

What is Truework?

Truework is the only all-in-one, automated VOIE platform that fully replaces in-house waterfalls for mortgage providers by orchestrating all major verification methods with a single platform. With Truework’s industry-leading 75% completion rate, mortgage providers achieve up to 50% cost savings and up to 80% completions in 24 hours.

Estimated Income is used as part of our quality assurance technology to provide 99.95% accuracy on our verification reports, no matter which verification methods are used.

Learn more at truework.com

Ready to learn more?

Run your VOIE process on our platform, and we’ll use multiple verification methods in an agile fashion to maximize that completion rate every time. If you want to learn more, reach out to us and let’s talk!