Strategies for success: Implementing quality control in mortgage lending

A mortgage loan cycle takes up to 45 days, starting from the loan application. Throughout this time, a mortgage lender pays in labor, administrative, equipment, and other production expenses, amounting to about $12,485 per loan.

While that’s a cost of doing business in the mortgage industry, any mistakes by the leasing team after incurring these expenses can be significantly detrimental since the mortgage company can’t hand over a loan with inaccuracies to a mortgage buying agency.

To avoid problematic loans in the lending pipeline, mortgage lenders need to adopt quality control practices in their mortgage lending system.

What is mortgage quality control?

Mortgage quality control (QC) refers to a systematic process of evaluating the mortgage pipeline to ensure it complies with relevant regulations, meets company-wide requirements, and outputs safer loans.

Typical processes of mortgage quality control include verifying the loan documentation, checking the internal mortgage processes, and looking for process gaps affecting the loan quality.

Importance of quality control in mortgage lending

Quality control in mortgage lending serves as a linchpin for lending companies since they need to ensure compliance with stringent regulations, meet standards of secondary markets, and mitigate the risk of costly buy-backs.

Compliance with relevant regulations

The mortgage lending space is heavily regulated, with laws dictating almost every mortgage loan process.

- Applicant screening: The Equal Credit Opportunity Act (ECOA) prevents lenders from discarding loan applicants based on their race, color, religion, sex, and marital status.

- Data handling: The Fair Credit Reporting Act (FCRA) requires lenders to comply with FCRA requirements when dealing with credit reports for loan underwriting. Mortgage lenders should also help applicants remove inaccuracies on their credit reports.

- Consumer privacy: The Gramm-Leach-Bliley Act (GLBA) requires lenders to protect the collected financial information from unauthorized access.

Other laws, such as the Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and Home Mortgage Disclosure Act (HMDA), outline how a mortgage company must share information on its offering, deal with escrow accounts, and disclose loan application activity.

Meet secondary market requirements

In addition to complying with government laws, mortgage companies must also address requirements set by investors in the secondary market while reviewing the loan applications. These requirements include minimum credit scores, debt-to-income ratio limits, essential documents, and other eligibility criteria.

Depending on the investor the mortgage company deals with, it can have differing process requirements. For instance, Fannie Mae requires a minimum credit score of 620 for fixed-rate loans for single-family homes.

Reduce buy-back risk

While it depends on the contract between the mortgage lender and the investor, the lender may need to repurchase a mortgage loan if a subsequent review finds major defects in the loan application.

As that can amount to huge losses for a mortgage company, improving the quality of loans that make it to the end of the loan cycle is the best course of action.

How to implement quality control in mortgage lending

To ensure accuracy, compliance, and efficiency throughout the loan origination process, mortgage lenders must implement quality control measures at every step of the mortgage process, from the initial applications to post-closing.

Document the existing mortgage process

Team leaders should walk the mortgage pipeline from start to finish and check how the team handles different tasks. They should then document the steps, ask employees about common mistakes, and check compliance risks.

For instance, they should check how lenders prepare loan documents in the pre-closing stage. Are they sending borrowers the closing disclosure at least three days before the closing date? Do they have a pre-funding QC review process to comply with relevant regulations?

Identify key risk areas

Team leaders should identify key risks in the existing mortgage processes based on the employees' feedback.

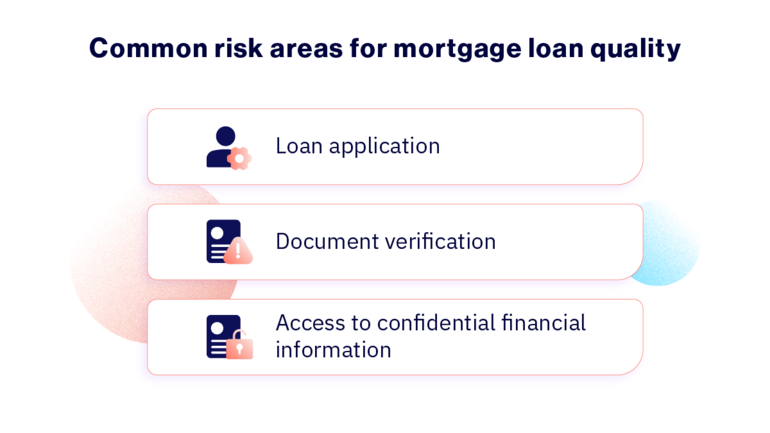

Common risk areas include:

- Loan application: Mortgage lending companies dealing in paper-based loan applications or inefficient application forms need their employees to manually enter the borrower’s information into their system, leaving room for human error.

- Document verification: Employees cannot detect the majority of document fraud since 90% of fraud signals are invisible to the human eye; fraudsters are even using fraudulent templates with all the right fonts and alignments. As a result, mortgage lenders relying on manual verification of documents may have to deal with an increased buy-back risk.

- Access to confidential financial information: With so many employees involved in the vetting of applicants, it can be difficult for mortgage companies to prevent information leaks and personal biases affecting loan decisions.

Add quality control reviews

Quality control shouldn’t be left as an afterthought when the loan application is near its finishing line. Instead, mortgage lenders must prioritize quality control by incorporating it into their processes.

For instance, lenders can require a second person to review the ongoing application after every significant step to prevent random typos, documentation mistakes, and incomplete applications from going forward.

Leverage technology to improve processes

While adding quality control reviewers in the loan process helps reduce errors, it also increases the associated labor costs, resulting in even higher loan production costs per loan.

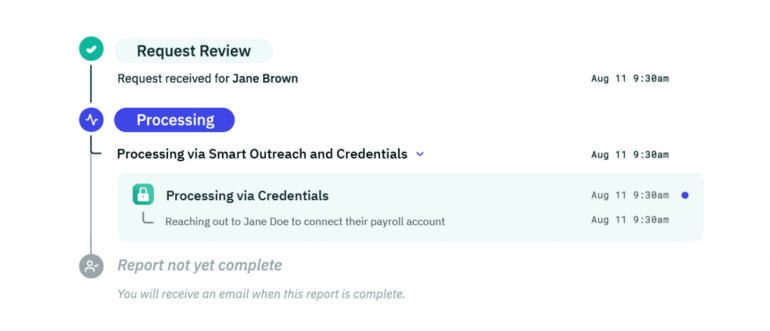

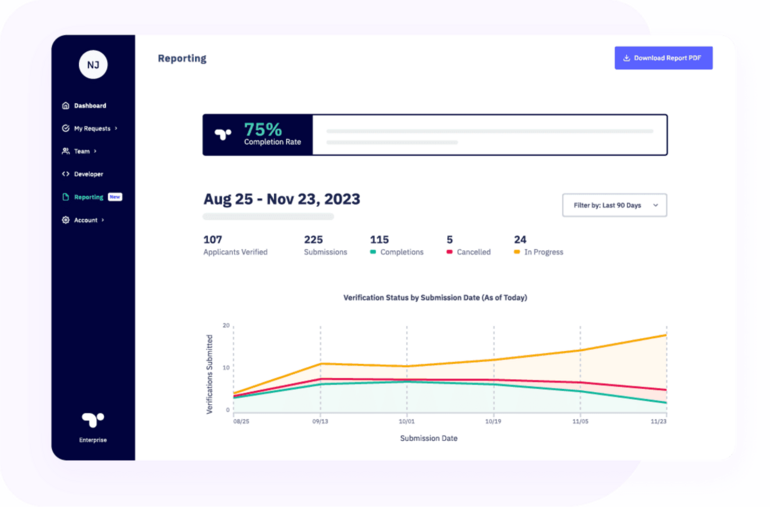

Alternatively, mortgage companies can work on integrating technology into their process. With Truework, mortgage lenders can improve their QC process without increasing mortgage origination costs.

Truework helps lenders verify borrowers’ income information, cut redundant manual steps, and avoid document fraud. As an FCRA-compliant solution, it also helps lenders comply with relevant regulatory requirements.

Truework is also an approved vendor for Fannie Mae’s Day 1 Certainty and Freddie Mac’s AIM, which can help lenders reduce their loan cycle times by up to 12 days.

Monitor performance

With a mortgage QC process, lenders will have more control over the loan files they forward to the investors.

That said, since no QC plan is foolproof, lending companies should also monitor metrics, such as loan defect rates, audit findings, and customer satisfaction scores to see where the company stands.

Besides that, the operations managers can also benefit from using process-specific metrics to visualize whether the employees are using the tools to improve the loan quality.

Level up mortgage processes with Truework

With the rising loan production costs, lenders need to check off every quality checklist the first time in their mortgage process to make their process leaner. That said, manual entries, document fraud, and strict regulatory requirements can be an uphill task for lenders.

Ready to learn more?

Try Truework Income for Mortgage today to automate many mortgage processes in one go.