How Mortgage Process Automation Helps Lenders Cut Costs and Optimize the Borrower Experience

Interest rates in the mortgage industry may be lower than their peak levels in October, but they’re expected to remain relatively high around 6% throughout the first half of 2024, if not the whole year. When combined with low inventory and increased selling prices, borrowers face a tough housing market, and lenders can’t count on a dramatic increase in housing sales in 2024.

As such, it’s no surprise that many lenders are turning to technology to keep costs and risks low while still providing exceptional customer service. In fact, 55% of mortgage companies planned to increase their tech spend in 2023, with top priorities including risk mitigation and data collection and analysis.

One of the key benefits mortgage lenders can enable with technology-driven solutions is mortgage process automation. This allows them to reduce costs, create operational efficiency, collect more accurate data, and grow their business without sacrificing the customer experience.

What is mortgage process automation?

Mortgage process automation refers to the use of technology-driven solutions to improve and accelerate the efficiency of tasks throughout the mortgage lifecycle. Automation helps mortgage lenders reduce the amount of resources needed for underwriting and loan origination. In turn, this helps lenders reduce costs and speed up mortgage loan processing.

The good news is that mortgage automation doesn’t mean lenders need to digitize the entire process. As it turns out, only 9% of borrowers would prefer a fully digital process. That said, most borrowers are open to digital services within the loan process, citing convenience as a top benefit.

When it comes to mortgages, not all applicants are the same. People most likely to opt for digital services are experienced borrowers who have already taken out at least five mortgages. Those with less experience may feel more comfortable with human touch points along the way to provide them with additional support and guidance.

Instead of fully digitizing loan applications from start to finish, lenders can focus on identifying parts of the mortgage underwriting process that would benefit from automation tools. Specifically, digital tools can be helpful for reducing repetitive tasks, lowering costs, and supporting a better customer experience.

For example, Truework helps lenders automate income verification, which traditionally has been a time-consuming and frustrating step for both lenders and borrowers.

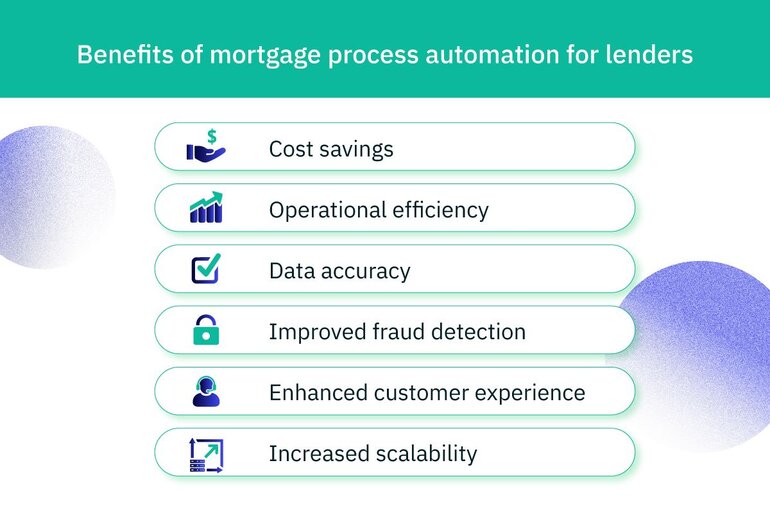

Top mortgage process automation benefits for your lending business

Automating different parts of loan origination creates several benefits for lenders and borrowers. Here are the key advantages.

Cost savings

Mortgage lenders can drive significant savings by automating costly elements of the underwriting process, such as income and employment verification. Working with legacy verification solutions often means managing multiple providers that don’t share data. This can result in lenders paying multiple times for the same verification and a lack of transparency into costs.

Truework Income lowers the total cost of verification by orchestrating requests across multiple methods from one central platform and ensuring lenders only pay for completed requests, not attempts.

Operational efficiency

Beyond being costly, traditional income and employment verification is tedious and time-consuming. By automating this process, lenders can save hours of work each week while still accurately verifying applicant information and reducing risk. Eliminating repetitive manual processes also frees up time for lending teams to focus on high-quality customer interactions.

More accurate data

Traditional income verification workflows come with a higher risk of inaccurate information due to manual data entry errors and human mistakes. Lenders can reduce their human error rates and increase the accuracy of information in the lending process by automating workflows like data extraction and analysis.

Improved fraud detection

Automation technology like machine learning algorithms and artificial intelligence (AI) is often better than humans at analyzing large amounts of data and identifying fraud risks.

Lenders can reduce the risk of overlooking sophisticated fraud attempts by leveraging software with fraud detection and prevention capabilities. For instance, Truework Documents uses intelligent document processing to support more accurate decision-making by alerting lenders to potential fraud during income verification.

Enhanced customer experience

In addition to cost savings and operational efficiency, workflow automation can enhance customer satisfaction.

Specifically, it creates a more seamless and convenient application experience by:

- Removing friction from the mortgage application process by digitizing steps like income verification.

- Leading to faster decisions and turnaround times.

- Eliminating manual workflows, giving mortgage loan reps more time to engage with customers.

- Providing loan reps with accurate data in real time, so they can better help borrowers navigate the loan process.

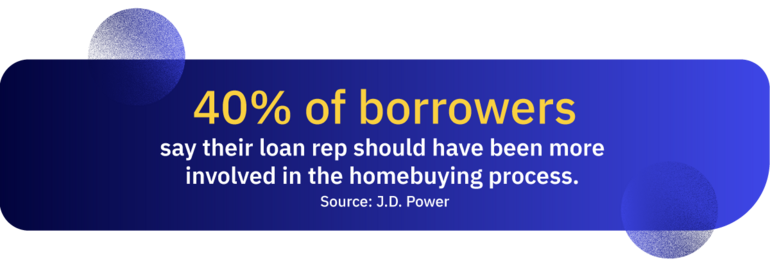

This isn’t to say that automated systems and digital processes should replace your customer-facing team. In fact, J.D. Power found that 40% of borrowers wanted their loan rep to be more involved in the mortgage lending process.

As such, it’s helpful to think about how automation and digitization can empower your team to have better customer interactions. With Truework Income, lenders have full visibility into the income and employment verification process, providing real-time data they can use to update applicants and let them know which steps need to be completed next.

Increased scalability

Technology-driven operational efficiency makes it easier to handle higher loan volumes without having to increase headcount. Not to mention, lenders can continue to provide an excellent customer experience and effectively mitigate risk, even as application volumes increase, by offloading repetitive tasks to automation software.

How Truework automated income verification streamlines the mortgage underwriting process

When it comes to mortgage underwriting, income and employment verification is a crucial part of ensuring you find the right borrowers and avoid issues like loan defaults and foreclosures.

Truework helps lenders improve the accuracy of their verifications while also making the process more efficient for lenders and applicants.

Multi-method income verification in one platform

Truework eliminates the need to work with multiple legacy verification providers by orchestrating each verification request across multiple methods, including:

- Instant

- Credentials (user-permissioned)

- Smart Outreach

- Documents

This centralized multi-method approach to income verification allows lenders to optimize completion rates and automatically verify up to 95% of the U.S. workforce, including independent contractors and gig workers.

Fast and accurate verifications

In addition to maximizing coverage, Truework gives lenders access to data for maximum accuracy. For manual verifications, Truework helps mitigate fraud by using fraud detection software (Documents) and following best practices with Smart Outreach, always verifying with third-party information instead of only relying on applicant-provided data.

When lenders submit a request, the platform automatically chooses the best method for each applicant to ensure fast turnaround times and lower costs. Lenders also receive full visibility into all requests, so they can track progress and keep applicants informed.

For added convenience and flexibility, Truework offers several options for submitting requests, including direct loan origination system (LOS) integrations, API connections, an online portal, and the ability to embed it directly into your loan application.

High completion rates

According to Upwork, 38% of the U.S. workforce includes professionals who performed freelance work. Millennials and Gen Z represent the generations most likely to engage in freelance work, suggesting that nontraditional income sources are here to stay. In 2023, millennials made up 28% of homebuyers, and Gen Z has started entering the market as well, making up 4% of buyers.

As more people turn to freelance work and the gig economy, lenders need to be able to verify less traditional and stable income sources, especially as younger generations enter the home-buying market. With Truework’s multiple methods, lenders can easily and accurately verify income for self-employed individuals and gig workers.

Automate the mortgage process with Truework

Mortgage automation can help many lenders increase loan volume while freeing up resources for other aspects of the mortgage lifecycle. That said, effective digital transformation doesn’t necessarily mean you need a fully digital process.

Instead, lenders can get the most out of mortgage automation by leveraging technology to handle the most costly and time-consuming business processes, such as income verification. With automation in the right place, lenders can cut down on costs, build operational efficiency, and optimize their borrower experiences.

Ready to learn more?

Learn more about Truework for mortgage lenders today and discover the difference that automated verification of income and employment can make for your business.