Truework 2025 Product Release

Supporting Truework’s intelligent income and employment verification platform are exciting product advancements in 2025 that help organizations reduce manual efforts, eliminate guesswork, consolidate vendors, and build an end-to-end verification experience to support business goals.

Consolidate vendors and maximize report completions with our orchestration engine

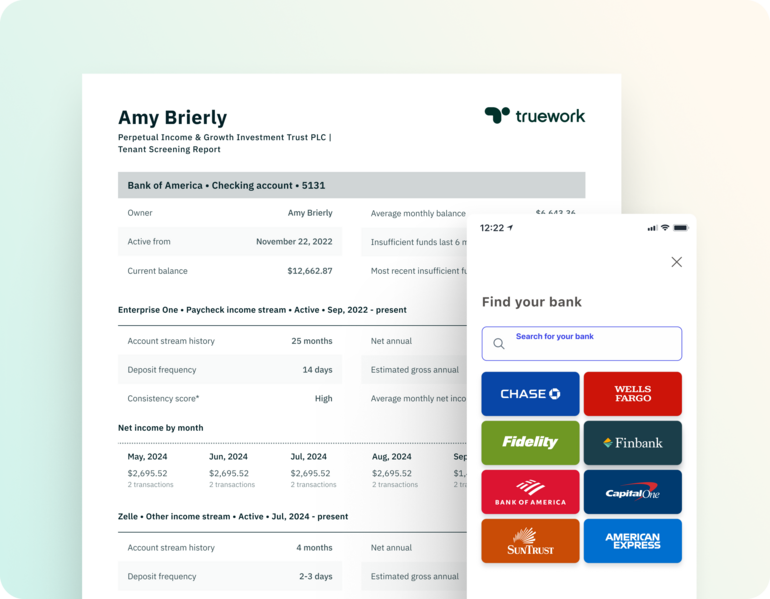

Income from Bank

Unlock the widest breadth of coverage across all income types with Truework’s consumer-permissioned bank connection. Borrowers or applicants securely connect one or multiple bank accounts to provide organizations with their assets, income streams, and employment information.

As part of Truework’s orchestration engine, bank income can be leveraged alongside Truework’s other verification methods in an automatic process to obtain a complete report without the need to ping multiple vendors or processes. Furthermore, bank income is an additional source of GSE-eligible income verification for our mortgage lenders.

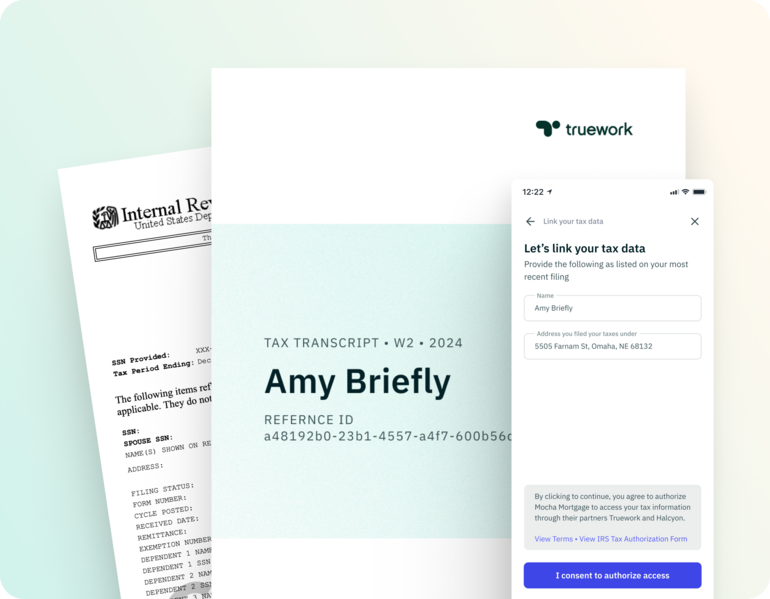

Tax Transcripts

Get GSE eligibility for self-employed individuals and social security income with Truework’s consumer-permissioned tax connection to the IRS. After the borrower or applicant provides their name, address, and consent, Truework directly retrieves tax transcripts to verify full income history needed for most use cases.

As part of Truework’s orchestration engine, tax transcripts can be leveraged alongside Truework’s other verification methods in an automatic process to obtain a complete report without the need to ping multiple vendors or processes.

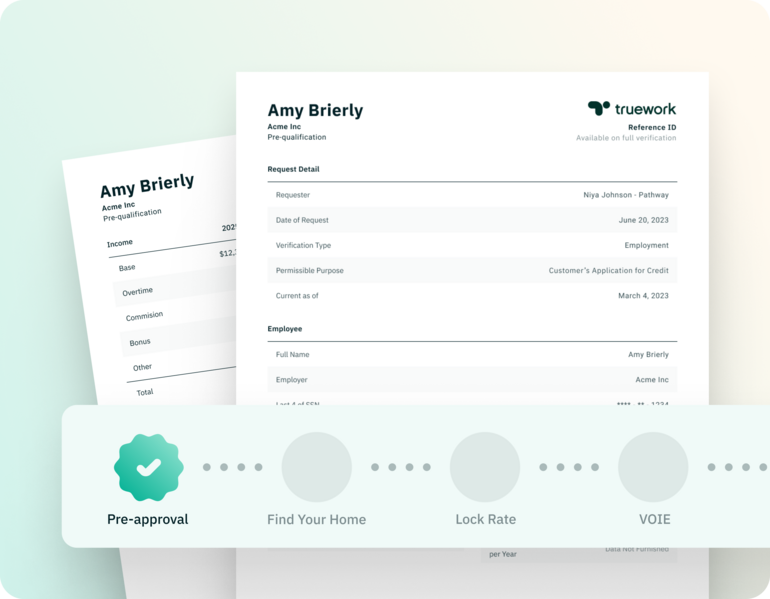

Pre-Approvals

Automate your pre-approvals process with our instant database, alongside an easy 1-click solution to advance any pre-approval to a full VOIE. This pre-approval upgrade process automatically completes the report only when your teams are ready to proceed with a borrower, helping you control costs and optimize conversion rates.

As part of Truework’s orchestration engine, pre-approvals can be leveraged alongside our other verification methods to consolidate processes, vendors, and costs.

Ensure report accuracy and reduce guesswork or risk of error with our validation engine

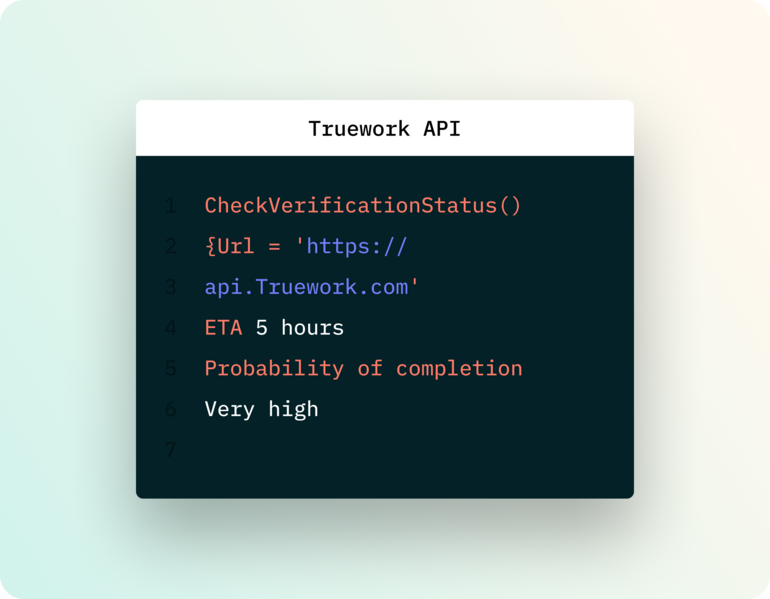

Predictions: Turnaround Time and Completion

Gain more transparency with the ability to see the likelihood of a request to complete, and how long it will take to complete. With vast domain knowledge and a dataset of hundreds of thousands of verifications, Truework compares a request to those like it from the past and models the remaining steps to completion, how long they will take, and the likelihood they will result in a successful completion.

This level of insight helps your organization better plan for and action on next steps without the need for manual overhead. Learn more about our predictive modeling.

Predictions are currently available via our API.

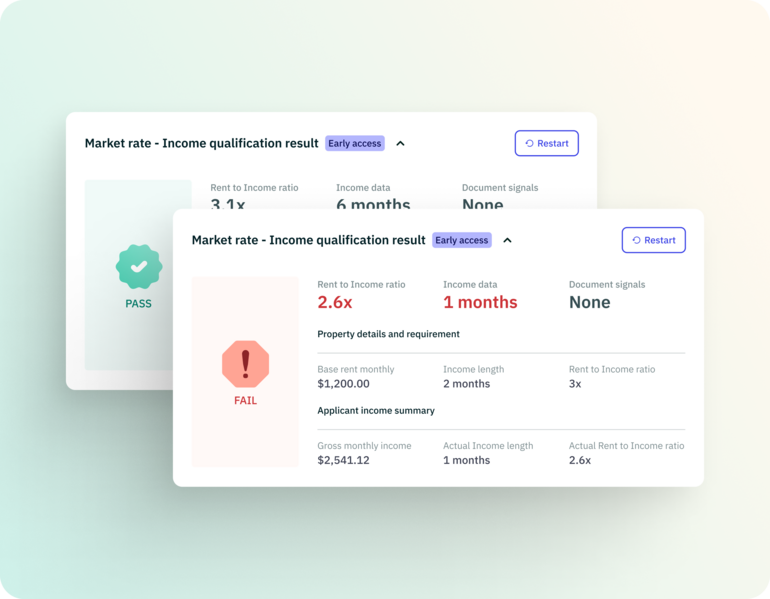

Income Qualification Checks

Automate rent-to-income calculations for property management teams, making it easier for them to assess if an applicant’s income qualifies and reducing chance of manual calculation errors. Based on pre-determined logic, teams get an instant pass, no pass, or more review needed response on completed verification reports.

Income Qualification Checks are currently available via our Fortress integration or API.

Bring intelligent verifications to where your teams already work with our new integrated partners

Blend

Truework’s verification service is embedded directly within Blend’s borrower and loan officer experience. Based on a few borrower inputs, income and employment data is automatically pulled from multiple data sources and populated back to the application and fully vetted and complete income reports are provided. Read our announcement.

TransUnion

TruVision™ Income and Employment Verification (Powered by Truework) enables a comprehensive income and employment verification waterfall now available via the TransUnion API. TruVision™ Income and Employment Verification provides lenders with access to Truework’s verification methods and orchestration in one single solution. Read our announcement.

Fortress

Property management teams initiate and manage verification requests and view completed reports directly from within Fortress’ application. In addition, income qualification checks are provided on reports to help teams assess rent-to-income calculations without manual effort.

"We are thrilled to partner with Truework, a trusted leader in income and employment verification and part of the TransUnion family of companies,” said Kerri Davis, CEO, Fortress PropTech. “This partnership with Truework is an extension of the exceptional partnership we've had with TransUnion over the past five years and further strengthens our ability to streamline the housing application process and provide more security and validation, creating even more savings and streamlined efficiencies for our customers."

RentCafe

Truework’s auto-screening capabilities within RentCafe allow you to set up custom business logic conditions to automatically order verifications, reducing screening-related tasks for property managers. With auto-screening, applicants are verified and ready for decisioning by the time the application reaches the property manager.

How to take advantage of these new developments

Mortgage lenders or property management companies are encouraged to reach out, either by contacting Sales or by contacting their Customer Success Manager, to learn more and be early adopters. Truework is conducting a phased rollout of these products, and timeliness of availability is subject to change.

Ready to unify your verification strategy?

Talk to our team about how Truework can help you reduce inefficiencies in your income verification process.